Fascination About Do You Have To Sign Up For Medicare At 65

Wiki Article

Our Medicare Part C Eligibility Ideas

Table of ContentsThe Best Guide To Shingles Vaccine CostThe 10-Minute Rule for Medicare Select PlansThe Ultimate Guide To Apply For MedicareWhat Does Aarp Plan G Mean?

Qualified Medicare Recipient (QMB) is a Medicaid program for individuals that are currently receiving Medicare advantages. The QMB program might differ by state.

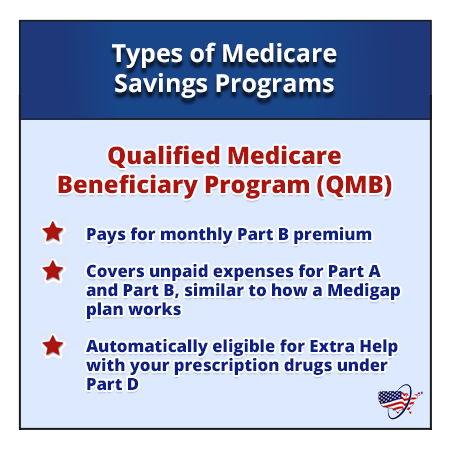

As with all Medicaid programs, QMB has earnings and also property limits that should be satisfied in order for a person to qualify for this program. Advantages of the QMB program consist of: Medicare Part A & B costs paid back in your Social Security Inspect Medicare Component D premium reduced or covered via the Reduced Revenue Subsidy (LIS)/ Extra Aid program Drug costs lowered to $0 $10 for a lot of medicines via the LIS/ Bonus Aid program No Donut Opening/ Coverage Gap Medicare deductibles paid by Medicaid Medicare coinsurance and also copays within recommended restrictions paid Right here is an example of how the QMB program can assist someone: When in the Donut Hole, Insulin can cost $300 per month.

The Main Principles Of Medicare Supplement Plans Comparison Chart 2021 Pdf

You can likewise reveal a duplicate of your Medicare Summary Notice. If you're charged, suggest the provider that you're enrolled in the QMB program - boomer benefits reviews.

It is necessary to know, nonetheless, that certain amounts of earnings are not counted in identifying QMB qualification - how does medicare part d work. Specifically if you are still functioning and also a lot of your earnings comes from your profits, you might have the ability to qualify as a QMB also if your complete earnings is almost two times the FPG.

If, after applying these rules, the figure you reach is anywhere near the QMB certifying limitation (in 2020, $1,083 in regular monthly countable income for a private, $1,457 for a pair), it deserves looking for it. (The limits are somewhat greater in Alaska and Hawaii.) Property Purview There is a restriction on the worth of the assets you can own and also still qualify as a QMB (medicare select plans).

Due to the fact that the SLMB and also QI programs are for people with greater incomes, they have less benefits than the QMB program. The SLMB and QI programs pay all or component of the Medicare Component B regular monthly premium, but do not pay any type of Medicare deductibles or coinsurance amounts. Nonetheless, this indicates prospective savings of greater than a thousand dollars per year.

The Buzz on Shingles Vaccine Cost

If you are discovered disqualified for one program, you might still be discovered eligible for one of the others. Where to Submit To get approved for the QMB, SLMB, or QI programs, you must submit a composed application with the firm that deals with Medicaid in your stateusually your region's Division of Social Providers or Social Welfare Department.Although a Medicaid qualification employee might call for extra particular information from you, you will certainly a minimum of be able to get the application process started if you bring: pay stubs, tax return, Social Protection advantages information, and various other proof of your existing earnings papers showing all your savings and various other financial properties, such as bankbooks, insurance plan, as well as stock certificates car enrollment documents if you own a car your Social Security card or number details about your spouse's revenue and separate possessions, if both of you live with each other, as well as clinical expenses from the previous three months, along with medical documents or records to verify any type of clinical problem that will require treatment in the close to future.

Ask concerning the treatment in your state for getting a hearing to appeal that decision. At an allure hearing, you will be able to present any kind of files or various other papersproof of income, assets, clinical billsthat you think sustain your claim. You will also be enabled to clarify why the Medicaid decision was incorrect.

You are permitted to have a close friend, family member, social employee, lawyer, or other depictive show up with you to assist at the hearing. The precise treatment for obtaining this hearing, and the hearing itself, may be somewhat various from state to state, they all appear like really carefully the hearings provided to candidates special info for Social Safety and security advantages.

Medicare Supplement Plans Comparison Chart 2021 Fundamentals Explained

Obtaining Aid With Your Allure If you are rejected QMB, SLMB, or QI, you may wish to consult with someone experienced in the subject to help you prepare your appeal. One area you can locate quality complimentary assistance with these issues is the nearby office of the State Medical Insurance Support Program (SHIP).Report this wiki page